Key Takeaways:

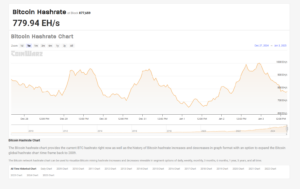

Bitcoin hashrate reached 1,000 EH/s, nearly doubling compared to January 2024. Major miners like Marathon hold BTC treasuries worth billions. Institutional interest in Bitcoin aligns with ETF growth and regulatory clarity.YEREVAN (CoinChapter.com) — The Bitcoin network’s hashrate hit an all-time high on January 3, briefly reaching 1,000 exahashes per second (EH/s). According to CoinWarz, this is nearly double the 510 EH/s recorded in January 2024. As of now, the hashrate has settled around 780 EH/s.

The increase in Bitcoin hashrate reflects a rise in miners dedicating computational power to the network. This growth improves security by making the blockchain more robust against potential threats.

Bitcoin Hashrate Peaks 1000 EH/s. Source: CoinWarzBitcoin Mining Expands Despite April Halving

Bitcoin miners continued to expand operations even after the April halving reduced mining rewards from 6.25 BTC to 3.125 BTC per block. Companies like Riot Platforms and CleanSpark increased their production capacity to maintain profitability.

A December 10 report by JPMorgan noted that some miners acquired turnkey facilities to boost their hashrate and secure reliable power supplies. Additionally, many mining companies focused on adding Bitcoin to their balance sheets, contributing to their long-term strategies.

Major miners, including Marathon, Riot Platforms, and CleanSpark, hold Bitcoin treasuries worth approximately $4.4 billion, $1.7 billion, and $910 million, respectively, according to BitcoinTreasuries.net.

Bitcoin Treasury and Holder Breakdown. Source: BitcoinTreasuries.netInstitutional Interest Aligns with Rising Bitcoin Hashrate

The increasing Bitcoin hashrate aligns with rising institutional interest in the cryptocurrency market. In November, Bitcoin exchange-traded funds (ETFs) surpassed $100 billion in net assets, as per data from Bloomberg Intelligence.

Sygnum, an asset manager, emphasized the importance of a secure Bitcoin network as more institutional capital flows into cryptocurrency. Improved regulatory clarity in the United States has further encouraged large investors, such as pension funds and sovereign wealth funds, to include Bitcoin in their portfolios.

Bitcoin Mining Companies See Adjusted Valuations

Bitcoin mining companies have seen shifts in stock valuations due to their operational expansions and asset holdings. According to JPMorgan, miners’ power assets and Bitcoin treasuries contributed significantly to their value.

For example, MicroStrategy traded at a 2.4x multiple of its Bitcoin holdings’ value as of December 10, highlighting the role of BTC assets in shaping market valuations.

The post Bitcoin Hashrate Reaches Record 1,000 EH/s appeared first on Coinchapter.