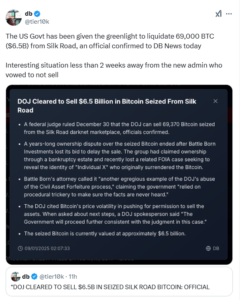

YEREVAN (CoinChapter.com) — A federal court ruling on Dec․ 30 authorized the Department of Justice (DOJ) to sell 69,370 BTC seized from the Silk Road marketplace. The Bitcoin, worth approximately $6.5 billion, will be liquidated before the new administration assumes office in 11 days.

Silk Road Bitcoin Liquidation Approved․ Source։ DB NewsThe DOJ requested expedited clearance, citing concerns about Bitcoin price volatility. Officials confirmed that the liquidation process will begin soon, ending a legal dispute over ownership of the seized Bitcoin.

Battle Born Investments Loses Legal Dispute

The decision concluded a years-long legal battle involving Battle Born Investments, which sought to delay the sale. The group’s attorney criticized the DOJ’s methods, calling them “procedural trickery,” and questioned the constitutionality of civil asset forfeiture. However, the court upheld the government’s right to proceed with the liquidation.

The DOJ argued that delays could harm the market by causing further fluctuations, emphasizing the need to act quickly. Officials stated that the sale would proceed in compliance with the court’s judgment, bringing an end to the ownership dispute.

Timing of Sale Raises Questions Amid Administration Transition

The timing of the court’s decision is significant, as the current administration moves to liquidate the Bitcoin before Donald Trump, the incoming president, takes office. Trump had previously campaigned to retain seized Bitcoin as part of a strategic reserve policy.

Previous sales of Silk Road Bitcoin were conducted during lower market cycles, including the 2013 seizure of 170,000 BTC, then valued at $28.5 million. Much of that Bitcoin was sold before its value soared, leading to missed profits.

Potential Market Impact of $6.5 Billion Bitcoin Sale

The market impact of the DOJ Bitcoin sale remains a topic of interest. Bitcoin’s trading range, between $92,000 and $100,000, suggests the potential for price fluctuations as large quantities enter the market.

Bitcoin Price Chart January 2025. Source: TradingViewOfficials have not disclosed how the sale will be conducted. However, prior liquidations of seized Bitcoin involved transfers to regulated exchanges, which have historically caused short-term price volatility.

Broader Implications of Silk Road Bitcoin Liquidation

The sale of the Silk Road Bitcoin highlights ongoing debates about government handling of cryptocurrency assets. While the liquidation aligns with past practices, the size of the cache has drawn heightened scrutiny.

The DOJ emphasized that the sale would proceed in a manner consistent with the ruling. The resolution of the legal conflict marks the final step in the multi-year process of managing the seized Bitcoin.

The post Federal Court Approves Silk Road Bitcoin Sale Before Administration Change appeared first on Coinchapter.